In today’s fast-paced world, unexpected expenses can arise anytime. For small financial needs, having quick access to a reliable loan can make all the difference. The True Balance Personal Loan ₹20,000 offers users an easy and fast way to borrow money digitally without the hassle of long procedures. This microloan is designed to support salaried individuals, freelancers, and self-employed professionals who need instant funds up to ₹20,000 for emergencies or planned expenses.

What is True Balance Personal Loan ₹20,000?

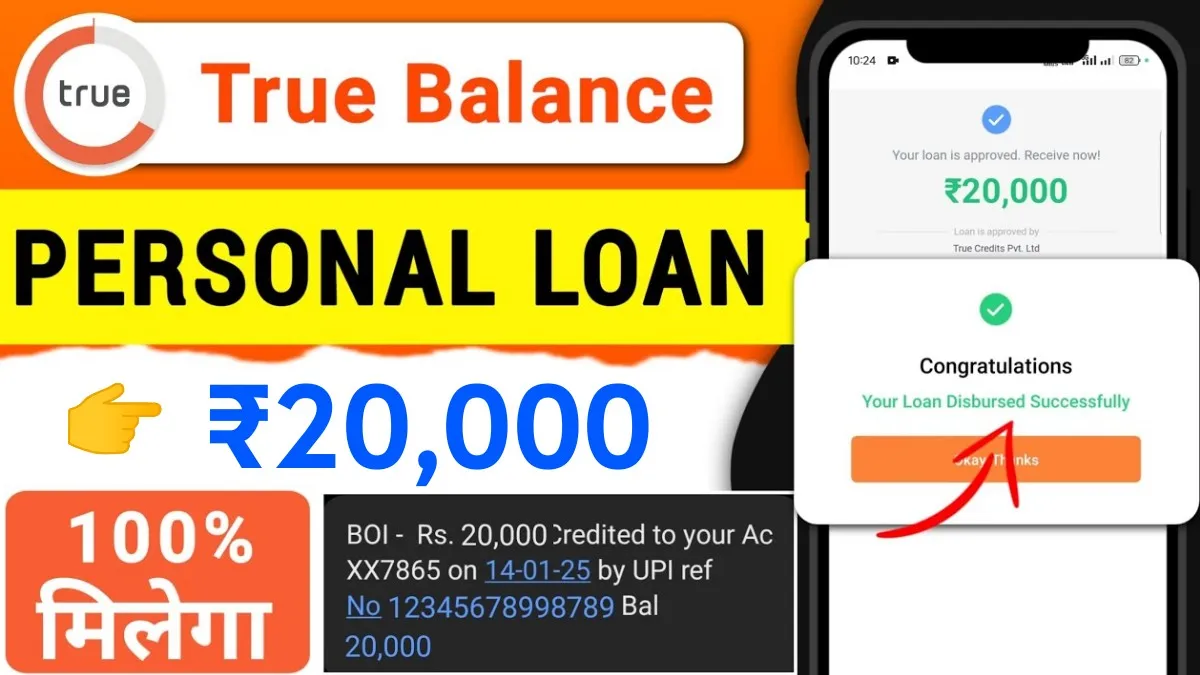

True Balance is a popular financial app that provides digital personal loans ranging from a few thousand up to ₹20,000. This loan is completely online, eliminating the need for paperwork or physical visits to a bank or lender. True Balance partners with trusted financial institutions to offer short-term credit solutions with flexible repayment options and transparent terms.

Key Features of True Balance ₹20,000 Personal Loan

- Loan Amount: Borrow up to ₹20,000 based on eligibility.

- Instant Approval: Quick loan sanction with minimal documentation.

- Fully Digital Process: Application, verification, and disbursal are done online via the app.

- Flexible Tenure: Repayment tenure ranges typically from 3 months up to 12 months.

- No Collateral Required: This is an unsecured loan.

- Competitive Interest Rates: Transparent interest with no hidden charges.

- Direct Disbursal: Loan amount is credited directly to your bank account.

Eligibility Criteria

To apply for a True Balance ₹20,000 personal loan, you typically need to meet the following criteria:

- Age: Between 21 and 50 years.

- Income: Minimum monthly income as per lender requirements.

- Employment: Salaried employees, self-employed individuals, or freelancers.

- KYC Documents: Valid Aadhaar, PAN, and bank account details.

- Credit Score: A reasonable credit history improves chances of approval.

How to Apply for True Balance ₹20,000 Loan?

Applying for a True Balance personal loan is simple and user-friendly:

- Download the True Balance App: Available on Android and iOS.

- Register and Login: Complete your profile with accurate details.

- Check Loan Eligibility: Use the app to see your loan limit.

- Apply for Loan: Choose ₹20,000 or less, select repayment tenure.

- Upload Required Documents: Submit KYC and income proofs digitally.

- Review and Confirm: Agree to terms and conditions.

- Receive Funds: After approval, loan amount is disbursed directly into your bank account, usually within 24 to 48 hours.

Benefits of True Balance ₹20,000 Loan

- Fast and Convenient: No long waits or paperwork, perfect for emergencies.

- Accessible: Designed for those with moderate credit scores or limited credit history.

- Flexible Repayment: Choose tenure and EMI amounts that fit your budget.

- Safe and Secure: Data protection and encryption ensure privacy.

- Transparent Process: Clear interest rates and fees without surprises.

- Credit Building: Responsible repayments can improve your credit profile.

Interest Rates and Charges

Interest rates on True Balance personal loans vary depending on loan amount, tenure, and borrower profile but typically range between 15% and 30% per annum. Processing fees and other charges are communicated upfront during application. Timely repayments help avoid penalties and maintain a good credit score.

Common Uses of True Balance ₹20,000 Loan

- Emergency medical expenses

- Educational fees or short courses

- Home or vehicle repairs

- Travel or personal events

- Small business needs or working capital

- Debt consolidation or other urgent financial requirements

Tips for Responsible Borrowing

- Borrow only what you truly need and can repay comfortably.

- Choose a repayment tenure that matches your financial capacity.

- Pay EMIs on time to avoid extra charges and improve credit score.

- Monitor loan status and payment schedule using the True Balance app.

- Avoid multiple simultaneous loans to maintain financial health.

Conclusion

The True Balance Personal Loan ₹20,000 is a practical and reliable financial product for those seeking quick digital credit without the burden of lengthy formalities. With easy eligibility, instant approval, and flexible repayment options, it provides a valuable lifeline for small financial emergencies or planned expenses. By using this loan responsibly, borrowers can manage their cash flow efficiently while building a positive credit history for future needs.